Introduction

Fintech APIs are revolutionizing the financial technology landscape, offering developers and businesses a multitude of benefits for their operations and services. These Application Programming Interfaces serve as the technological glue that seamlessly connects disparate financial systems, enabling streamlined and efficient financial transactions. By providing access to a treasure trove of financial data and services, Fintech APIs empower developers to create innovative applications that enhance user experiences and drive productivity.

From accelerated development and enhanced user experience to access to diverse financial services and improved scalability, Fintech APIs are reshaping the way we interact with money and transforming traditional financial services. This article explores the benefits, types, and use cases of Fintech APIs, highlighting their pivotal role in ushering in an era where finance and technology merge to produce efficient, accessible, and transparent systems.

What Are Fintech APIs and How Do They Work?

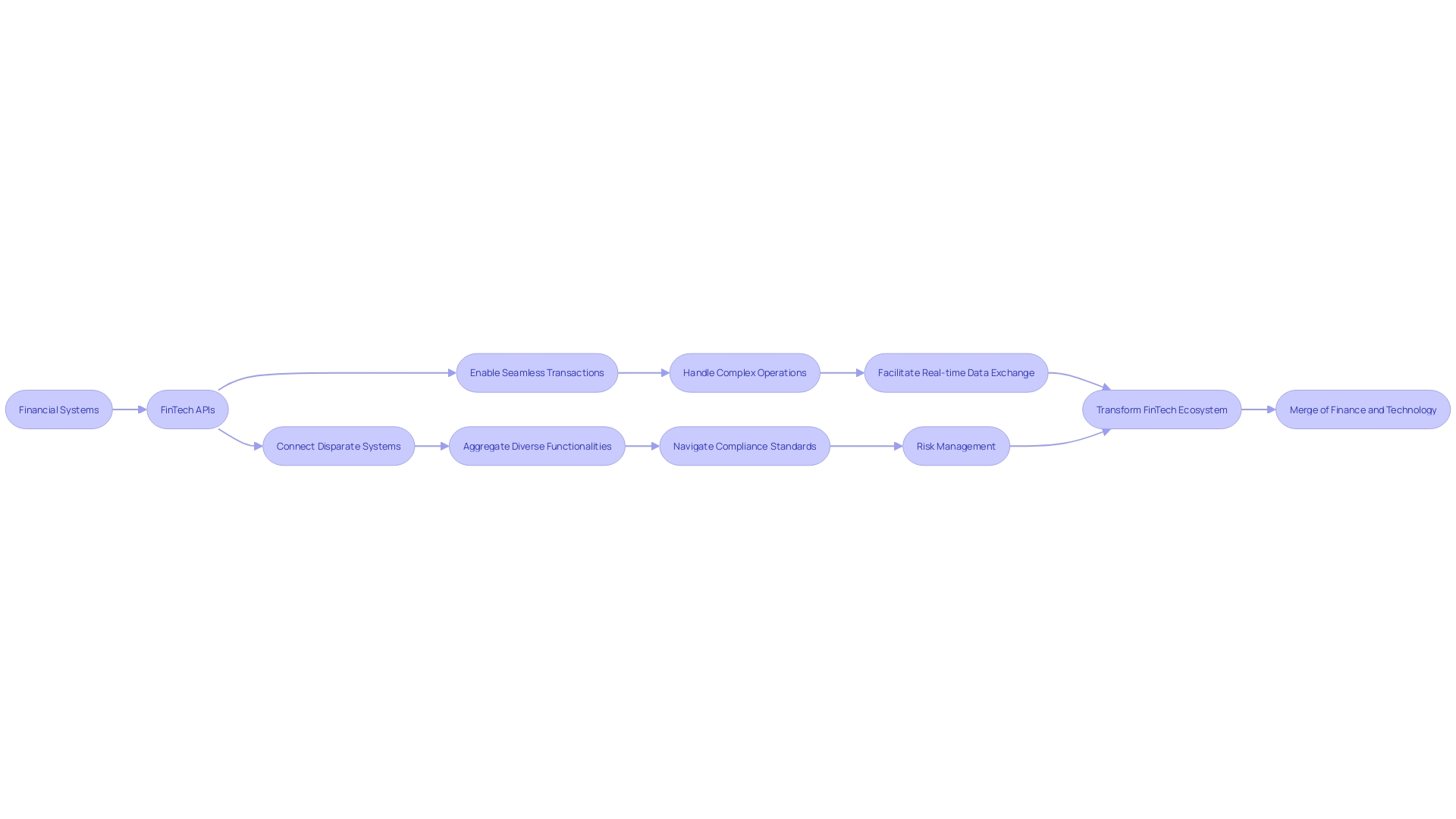

FinTech APIs are the technological glue that connects disparate financial systems, enabling a world where seamless financial transactions are the norm. These Application Programming Interfaces provide developers with the keys to a treasure trove of financial data and services. They allow for the aggregation of diverse functionalities from multiple sources, offering a standardized approach to handling complex financial operations.

Imagine the intricacies involved in generating compliant invoices across various jurisdictions; each with its own tax regulations, ID requirements, and document formats. FinTech APIs help to navigate this maze by providing developers with the tools to create solutions that automatically adhere to these diverse compliance standards, avoiding costly errors and inefficiencies.

The importance of Fintech APIs extends to risk management, where they offer a dynamic way to perform comprehensive financial analysis. By providing real-time data, APIs allow for immediate risk assessments, a leap forward from the static reports of old. This real-time data exchange is critical, as highlighted in recent conferences such as Swiss WealthTech Live and the NextGen Payments and Regtech Forum, where industry leaders discuss the transformation of financial services through technology.

With these APIs, developers are no longer bogged down by the minutiae of financial regulations and can instead concentrate on enhancing user experiences and creating innovative applications. As a result, the FinTech ecosystem is rapidly evolving, with embedded finance changing our interactions with money and traditional financial services being challenged by tech-driven solutions. FinTech APIs are at the forefront of this transformation, ushering in an era where finance and technology merge to produce systems that are not only more efficient but also widely accessible and transparent.

Benefits of Fintech APIs

FinTech APIs are transforming the financial technology landscape by offering developers and businesses a multitude of essential benefits for their operations and services:

-

Accelerated Development: Utilizing Fintech APIs, developers gain access to pre-built functionalities and data, bypassing the need for ground-up creation. This enables rapid application development and deployment, a crucial factor for staying competitive in the fast-paced fintech arena.

-

Enhanced User Experience: These APIs empower developers to integrate a broad spectrum of financial services, delivering a cohesive and smooth user experience. The incorporation of features such as payment processing and account management directly correlates with increased user satisfaction and retention.

-

Access to Diverse Financial Services: Developers are afforded the opportunity to tap into a wide array of financial services through Fintech APIs. This access is pivotal for crafting comprehensive financial applications that cater to the multifaceted needs of users, ranging from identity verification to account aggregation.

-

Improved Scalability: Businesses can scale their operations with minimal development overhead thanks to the modularity of FinTech APIs. This scalability is vital for integrating additional services or branching into new markets, setting the foundation for growth and adaptability.

-

Collaboration and Innovation: A thriving ecosystem is fostered by Fintech APIs, which encourage developers to build upon existing services and innovate. This collaborative environment is key to creating novel solutions that drive the industry forward.

The strategic use of Fintech APIs not only streamlines the development process but also enhances the overall financial landscape by making it more efficient, transparent, and user-centric.

Types of Fintech APIs

FinTech APIs are integral to the financial technology landscape, providing the infrastructure needed to execute various services that enhance the user experience in financial transactions. Here's a closer look at some prevalent Fintech API categories:

-

Payment APIs facilitate diverse payment options, including credit cards, digital wallets, and bank transfers, by seamlessly integrating payment processing into applications. This not only adds convenience but also ensures transactional security.

-

Account APIs offer developers tools to access essential account information such as balances, transaction histories, and detailed account data, enabling them to create sophisticated applications that assist users in managing and tracking their financial activities.

-

Identity Verification APIs are imperative for maintaining security in financial applications. They employ methods like document checks, biometric scans, and facial recognition to authenticate users, which is crucial for adhering to compliance standards.

-

Market Data APIs supply both real-time and historical data on financial markets, including stock prices, exchange rates, and indices. These APIs are valuable for developers aiming to build robust applications that support market analysis, investment strategies, and portfolio management.

-

Lending APIs incorporate loan processing and management within applications. They support the entire loan lifecycle from application to credit evaluation and repayment tracking, streamlining the borrowing experience.

In an era marked by rapid technological advancements, APIs are revolutionizing financial services by making them more accessible, efficient, and transparent. They enable real-time data sharing and collaboration across platforms, which is essential in today's interconnected digital environment. As we observe the FinTech space evolve, APIs continue to serve as the critical conduits that facilitate this transformation, ensuring that financial data remains the cornerstone of sound investment decisions and strategic financial planning.

Use Cases for Fintech APIs

FinTech APIs, the technological glue binding various financial services, have become integral in transforming the financial landscape. Their applications are as diverse as the industries they serve.

-

Payment Processing: The e-commerce boom has seen fintech APIs become indispensable in facilitating transactions. By bridging multiple payment services, they ensure that customers can pay easily and securely, regardless of their preferred gateway.

-

Personal Finance Management: FinTech APIs empower budgeting tools like YNAB to help users take control of their finances. By aggregating data from various institutions, these APIs provide a comprehensive financial picture, enabling users to track spending and optimize savings.

-

Wealth Management: Investment platforms are harnessing the power of FinTech APIs to offer enhanced services such as real-time market data and automated trading, which democratize access to wealth management.

-

Digital Banking: In the realm of digital banking, fintech APIs are the cornerstone, supporting mobile banking apps and open banking initiatives. They streamline operations from account management to identity verification, catering to the modern consumer's expectations for quick and reliable banking services.

-

Risk Assessment and Fraud Detection: Leveraging sophisticated algorithms and machine learning, fintech APIs are at the forefront of combating fraud. They analyze vast amounts of transaction data to identify patterns and prevent financial crimes before they occur.

These use cases underscore the transformative role of FinTech APIs in not just enhancing user experiences but also in reshaping the financial services industry to be more efficient, accessible, and transparent. As FinTech continues to evolve, APIs will remain pivotal in connecting the dots between innovation and functionality, driving progress in the sector.

Conclusion

Fintech APIs are revolutionizing the financial technology landscape by seamlessly connecting disparate financial systems and empowering developers to create innovative applications. These APIs offer accelerated development, enhanced user experience, access to diverse financial services, improved scalability, and foster collaboration and innovation.

With pre-built functionalities and data, developers can rapidly develop and deploy applications, staying competitive in the fast-paced fintech arena. Integrating various financial services enhances the user experience, leading to increased satisfaction and retention.

Access to diverse financial services is crucial for crafting comprehensive applications that cater to users' multifaceted needs. The modularity of Fintech APIs enables businesses to scale their operations with minimal development overhead, allowing for growth and adaptability.

Fintech APIs foster collaboration and innovation, driving the industry forward and shaping efficient, transparent, and user-centric financial systems.

Payment APIs ensure transactional security and convenience, while Account APIs provide tools for accessing essential account information. Identity Verification APIs maintain security, and Market Data APIs support market analysis and investment strategies. Lending APIs streamline the loan lifecycle, improving the borrowing experience.

The use cases of Fintech APIs demonstrate their transformative role in payment processing, personal finance management, wealth management, digital banking, and risk assessment. These APIs enhance user experiences and reshape the financial services industry to be more efficient, accessible, and transparent.

In conclusion, Fintech APIs revolutionize the financial technology landscape, offering benefits such as accelerated development and improved scalability. As the fintech ecosystem evolves, Fintech APIs will continue to drive progress, ushering in efficient, accessible, and transparent financial systems.

Experience the power of Fintech APIs and accelerate your app development process today!

Frequently Asked Questions

What are FinTech APIs?

FinTech APIs (Application Programming Interfaces) are tools that connect different financial systems, allowing for seamless financial transactions and access to a range of financial data and services. They enable developers to build applications that can handle complex financial operations in a standardized way.

How do FinTech APIs benefit developers and businesses?

FinTech APIs offer several benefits, including accelerated development, enhanced user experience, access to diverse financial services, improved scalability, and fostering collaboration and innovation within the financial technology landscape.

Can FinTech APIs help with compliance and regulation?

Yes, FinTech APIs can navigate the complexities of compliance and regulations across various jurisdictions by providing tools that automatically adhere to different compliance standards, such as tax regulations and ID requirements.

Why are FinTech APIs important for risk management?

FinTech APIs are crucial for risk management as they provide real-time data that allows for immediate risk assessments, which is a significant advancement over static reports. This helps in making more dynamic and informed financial decisions.

What are some types of FinTech APIs?

Common types of FinTech APIs include Payment APIs, Account APIs, Identity Verification APIs, Market Data APIs, and Lending APIs. Each category serves a specific function, from processing payments to providing market insights and managing loans.

How do Payment APIs contribute to financial transactions?

Payment APIs facilitate various payment options such as credit card transactions, digital wallets, and bank transfers. They integrate payment processing into applications securely and conveniently.

What role do Identity Verification APIs play in financial applications?

Identity Verification APIs are essential for security in financial applications. They use document checks, biometric scans, and facial recognition to authenticate users, ensuring compliance and preventing fraud.

What kind of market information do Market Data APIs provide?

Market Data APIs supply both real-time and historical data on financial markets, such as stock prices, exchange rates, and indices, which is valuable for building applications that support investment strategies and market analysis.

In what ways are FinTech APIs transforming the financial industry?

FinTech APIs are transforming the financial industry by making financial services more accessible, efficient, and transparent. They facilitate real-time data sharing, collaboration, and innovation across various financial applications and platforms.

What are some practical use cases for FinTech APIs?

Practical use cases for FinTech APIs include payment processing for e-commerce, personal finance management, wealth management services, digital banking, and risk assessment and fraud detection. These APIs enable a wide range of financial functions and contribute to the modernization of the financial services industry.