Introduction

Understanding the intricacies of payment processing is crucial for businesses to thrive in the digital marketplace. A Payments API serves as a digital conductor, seamlessly managing transactions between merchants, customers, and financial institutions. It enables businesses to accept a wide range of payment methods, enhancing the user experience through convenience and choice.

Security is also a top priority, with measures in place to protect sensitive information. Payment APIs, like Razorpay, exemplify the versatility and seamless integration of this technology across different platforms. Furthermore, decoding API payment responses provides valuable insights for businesses to streamline their payment processes.

As the digital payments landscape evolves, clear API documentation and user education become increasingly important. The Global Payments Report 2023 reveals the growing popularity of alternative payment methods and real-time transactions. In summary, Payment APIs are pivotal in facilitating efficient and secure transactions in the digital economy, empowering businesses to conduct transactions with ease and effectiveness.

What is a Payments API?

Understanding the intricate web of payment processing is critical for businesses aiming to thrive in the digital marketplace. A Payments API serves as a digital conductor, expertly managing the flow of transactions between merchants, customers, and financial institutions. This sophisticated technology enables businesses to accept a diverse array of payment methods, such as credit cards, digital wallets, and bank transfers, enhancing the user experience through convenience and choice.

At the heart of a Payments API is the ability to facilitate secure transactions. As we navigate an era where online privacy is paramount, it's crucial to ensure that sensitive information, like API keys and user credentials, is guarded with the utmost security. Employing measures like environment variables and secure storage practices is non-negotiable for maintaining a fortified payment environment.

To illustrate, Razorpay, a prominent payment processor in India, exemplifies the seamless integration and versatility of Payment APIs. Developers, without the need for specialized software development kits (SDKs), can adapt Razorpay's API to various programming languages, ensuring a broad applicability across different platforms.

Moreover, the importance of understanding and interpreting API payment responses cannot be overstated. By decoding the components of these responses, such as the amount, currency, country, payment type, and customer ID, businesses can gain deeper insights into their transactions. This understanding is crucial for both novice developers and seasoned professionals who are striving to streamline their payment processes.

Recent news highlights the evolving landscape of digital payments. For instance, Mercari's introduction of a Bitcoin payment feature not only diversifies payment options but also aims to demystify cryptocurrency for its users. However, with only 45.7% of users in a recent survey fully grasping Bitcoin's utilization, the need for clear and accessible API documentation and user education is evident.

The Global Payments Report 2023 underscores this transformation, revealing that alternative payment methods and real-time transactions are gaining momentum. For businesses looking to expand into new markets or stay ahead of trends, this report is an invaluable resource, offering a comprehensive view of consumer payment preferences worldwide.

In sum, the orchestration of Payment APIs is pivotal for the fluid exchange of currency in today's digital economy, empowering businesses to conduct transactions with efficiency and security. Whether for B2C, B2B, or peer-to-peer transactions, these APIs are the linchpin in a successful digital payment strategy.

Benefits of Using a Payments API

Harnessing the power of a Payments API can transform the way businesses and developers handle transactions. It's not just about transferring funds; it's about enhancing the user experience and streamlining complex processes. When it comes to simplifying payment processing, these APIs are a game-changer.

They reduce the intricacies and time involved in managing transactions, making the payment journey as smooth as possible for both the business and the customer.

A standout benefit is the flexibility in payment methods that a Payments API provides. Catering to a diverse customer base is key to increasing conversion rates, and with the inclusion of various payment options, businesses can appeal to a broader audience.

Security is paramount in digital transactions, and Payments APIs come equipped with stringent security protocols such as encryption and tokenization. These measures are essential in safeguarding sensitive customer data against potential breaches.

For businesses anticipating growth, scalability, and reliability are critical. Payments APIs are designed to handle a surge in transaction volumes, ensuring consistent performance even during peak demand.

Moreover, the advanced features that many Payment APIs offer, like recurring payments, subscription management, and fraud detection, are invaluable tools. These features empower businesses to innovate and provide sophisticated solutions to their customers.

To illustrate the practical application of a Payments API, consider the Payment Object in API Payment responses. This object typically includes critical fields like the transaction amount, currency, payment type, and an identifier for the customer, which are essential for processing B2C transactions effectively.

In the context of the evolving digital economy, where even Gen Z's shopping preferences can present a $72 billion opportunity, the implementation of advanced Payment APIs is not just beneficial but necessary. As the digital landscape shifts, with brands and online marketplaces vying for consumer attention, the ability to process payments efficiently becomes a competitive advantage.

The advent of cryptocurrency payments further underscores the importance of versatile APIs. As businesses adapt to accept virtual coins like Bitcoin, the complexity behind the scenes increases. The interaction between the sender's wallet, gateway, blockchain, and merchant account requires a robust API to initiate and complete transactions.

In the bigger picture, APIs are the foundational components of software development, hailed by Google as 'the crown jewels'. They facilitate collaboration among developers and stakeholders, leading to system improvements and spurring innovation. In a market that's always advancing, integrating a Payments API isn't just a smart move—it's an essential step towards future-proofing your business operations and staying ahead in the game.

Key Components of a Payments API

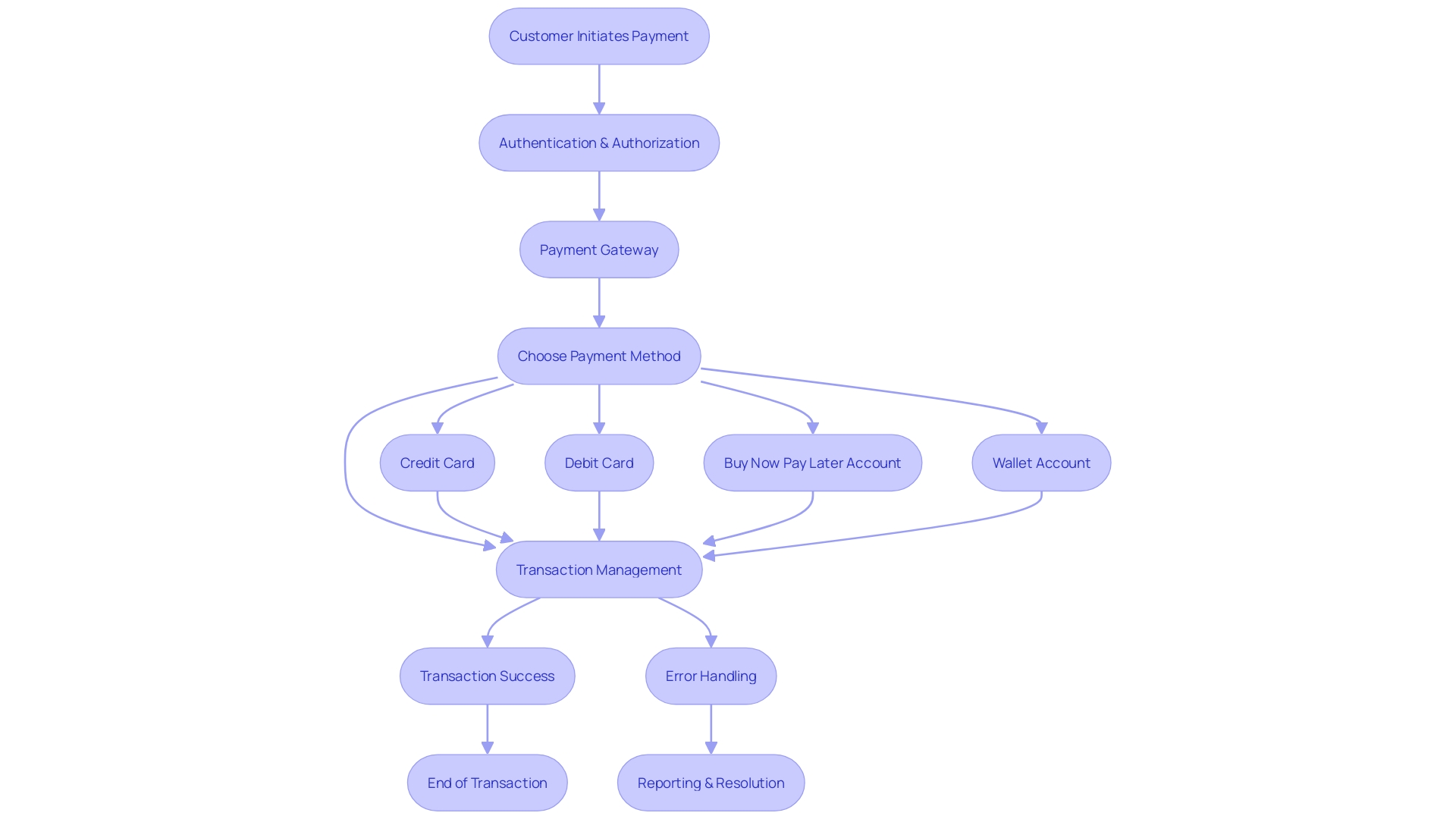

Delving into the mechanics of Payment APIs uncovers a critical infrastructure in today's digital marketplace. These APIs are the unsung heroes behind the 'click to purchase,' performing a ballet of data exchanges and transactions. A Payments API isn't just a single entity but a constellation of components working in harmony to facilitate the smooth transfer of funds between entities—be it from consumer to business (B2C), business to business (B2B), or even peer to peer (P2P).

-

Authentication and Authorization: In the intricate dance of payment processing, authentication ensures that the right users have access to transactional capabilities. Much like a gatekeeper, it's the first step in safeguarding the transactional integrity.

-

Payment Gateway: This component is the linchpin that connects your application to the payment processing networks. It enables the complex dialogue between your service and the financial institutions to transact swiftly and securely.

-

Payment Methods: Flexibility is key in accommodating customer preferences. Payment APIs must adeptly handle an array of payment instruments—credit cards, debit cards, digital wallets, and bank transfers—each with their distinct protocols and specifications.

-

Transaction Management: Transaction management is the orchestration core of Payments APIs, providing tools for initiating payments, processing refunds, and keeping a diligent eye on the pulse of each transaction's status.

-

Error Handling and Reporting: When discrepancies arise, robust error handling and detailed reporting become indispensable. They act as the diagnostic tools that developers rely on to troubleshoot and resolve issues, ensuring a seamless payment experience.

Understanding these components is pivotal for developers and businesses looking to harness the power of Payment APIs to drive success. As the Global Payments Report 2023 indicates, navigating the complexities of payment preferences and trends is crucial for expansion and customer satisfaction. By engaging with our community forum, developers can deepen their understanding, share knowledge, and stay ahead in the rapidly evolving world of digital payments.

How to Integrate a Payments API

Embarking on the integration of a Payments API into your application can be a transformative step towards achieving efficient and seamless payment transactions. Begin this journey by selecting a premier Payments API provider such as Razorpay, a leader in India's payment processing space, offering a full spectrum of payment solutions tailored for both businesses and individuals.

After choosing your provider, sign up and secure your API credentials. These credentials are the keys to your integration, enabling secure authentication in your payment system. Razorpay, for instance, simplifies this process, allowing you to quickly move forward to the next critical step: delving into the API documentation.

API documentation is the blueprint of your integration. It is imperative to comprehend the provided materials carefully, as they include intricate details about API endpoints, expected request/response formats, and necessary authentication procedures. For instance, Razorpay's documentation offers thorough guidance that can be translated across different programming languages, ensuring adaptability regardless of your chosen tech stack.

With a solid understanding of the documentation, proceed to write the integration code. Whether you're coding in Python, as we'll discuss here, or any other language, follow the API provider's examples as a guide. Security should be a priority; safeguard sensitive data like API keys using environment variables or other secure storage methods.

GitHub repositories, like the one we reference for a React Play Button component, can be a valuable resource for finding relevant code.

Testing and debugging are where you ensure that your integration stands strong. Create test transactions and meticulously verify outcomes, employing debugging tools to swiftly resolve any issues. Your goal is to achieve a flawless payment process before launching it to the public.

When you're confident in the robustness of your integration, it's time to transition to the live environment and begin processing real transactions. As you do so, keep a vigilant eye on the system to ensure its smooth operation and swiftly address any customer queries or concerns.

Throughout this integration journey, remember that you're not alone. Developer communities, such as those discussed in industry events for web3 products, can be a valuable support network. Engage in community discussions, stay updated with the latest news by following relevant social media channels, and leverage how-to videos for additional insights.

Common Payment APIs: Overview and Comparison

Selecting the right Payment API is critical for online transactions, and the market offers several top contenders. Stripe stands out for its extensive capabilities, supporting a variety of payment methods, subscription management, and robust fraud prevention mechanisms. Its API is designed to encapsulate complexity and streamline payment processing, allowing businesses to focus on their core value proposition.

PayPal, with its global reach, allows businesses to accept payments in numerous currencies, catering to a wide customer base. It's known for its reliability and ease of use, making it a staple in the e-commerce world.

Braintree, a PayPal service, provides a seamless integration that supports recurring billing and mobile payments, offering a refined experience for both businesses and customers.

Square's API is tailored for both in-person and online transactions, featuring customizable options to suit different business models and a suite of hardware for physical point-of-sale (PoS) systems.

When deciding on a Payment API, it's essential to weigh factors such as integration simplicity, payment methods supported, transaction fees, and developer support. For example, Stripe's API handles an impressive volume of API requests daily, peaking at 13,000 requests per second, highlighting its scalability and reliability. Additionally, the rise of cryptocurrency transactions necessitates considering APIs that support digital currencies, reflecting modern payment trends.

The choice of a Payment API can significantly impact your business, and with the diversity of options available, it's crucial to select one that aligns with your business objectives and customer needs.

Security Considerations for Payments APIs

When implementing Payment APIs, it's paramount to ensure robust security measures are in place. For starters, leverage HTTPS to encrypt sensitive data in transit. This precautionary step is akin to securing a treasure during transportation, guaranteeing that prying eyes cannot decipher the precious cargo.

Tokenization is another critical safeguard. By substituting real card details with secure tokens, you're essentially converting sensitive information into a cryptic puzzle that only the Payments API can solve. It's a powerful tactic to fortify customer payment data against breaches.

Being PCI DSS compliant is not just a recommendation; it's a mandate if your application touches cardholder data. Think of it as a badge of honor that signifies your commitment to safeguarding payment information within the fortified walls of industry standards.

Integrate two-factor authentication as an additional bulwark for user accounts with access to the Payments API. This is akin to having a double-lock system, ensuring only authorized personnel can pass through the security checkpoint.

Lastly, conducting periodic security audits and vulnerability assessments is akin to regularly checking the integrity of your fortress. It's essential to identify any chinks in the armor and reinforce them before they can be exploited.

In the realm of Payments APIs, staying abreast of the latest security practices and guidelines is not optional; it's crucial. As illustrated by Razorpay, a leading payment processor, the seamless integration of payment functionalities into applications can significantly enhance the user experience. And as PayPal APIs demonstrate, the ability to navigate payment responses is vital for seamless transactions.

Remember, in the digital economy, the ability to process payments seamlessly is what keeps the wheels of commerce turning. As stated by industry experts, the whole purpose of a payment API is to facilitate the movement of funds, ensuring the digital marketplace thrives on secure and efficient transactions.

Best Practices for Implementing Payments APIs

Integrating Payments APIs into your application requires attention to several critical practices to ensure seamless transactions and customer satisfaction. To start, comprehensively read and comprehend the API documentation provided. This documentation is your roadmap to utilizing the API's full capabilities, guiding you through the intricate details necessary for effective use.

Next, implement idempotent requests. Idempotency is essential in payment processing; it shields against the repercussions of duplicate submissions, such as unintended multiple transactions. With idempotent requests, the same operation can be safely repeated without adverse effects.

Webhooks are another powerful tool at your disposal. They enable real-time updates on payment events, alerting you to successes and failures as they happen, which is crucial for maintaining up-to-date transaction records.

When it comes to errors, they are inevitable, but your system's response can make all the difference. Graceful error handling not only aids in debugging but also enhances user experience by providing clear and useful feedback rather than cryptic error codes.

Monitoring your system's performance is not a one-time task but an ongoing process. Keep tabs on response times and error rates, and be prepared to optimize and adjust as needed to maintain peak performance.

Lastly, security is paramount, especially with sensitive financial data. Protect your API credentials zealously. Hardcoding them into your application's source code is a risky practice; instead, opt for secure storage solutions to shield against unauthorized access.

By adhering to these best practices, you position your business to capitalize on the powerful conduit that Payment APIs provide—transferring funds efficiently and safely in the bustling digital marketplace.

Troubleshooting Common Issues with Payments APIs

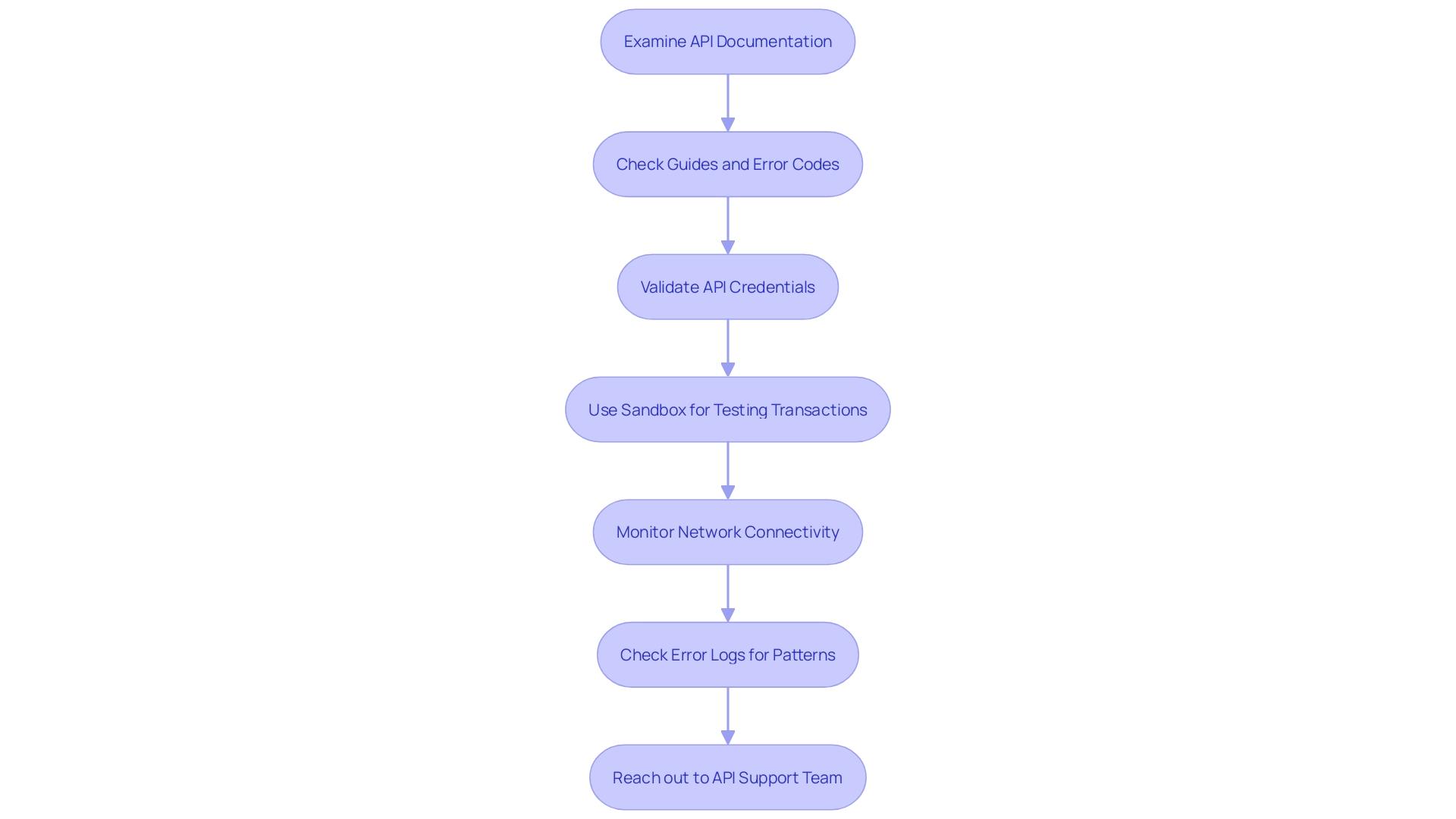

Navigating through the digital economy's intricate landscape, Payment APIs serve as the pivotal mechanism that smoothly conduct transfers of funds. As a developer, encountering and resolving issues with these APIs is part of ensuring a frictionless payment process. When troubleshooting, begin by examining the API documentation, which is replete with guides and common error codes that might shed light on the issues at hand.

Next, validate API credentials meticulously; even a minor lapse can cause authentication failures. For isolating problems, leverage the sandbox environment provided by most Payment APIs. It's an ideal testing ground for transactions before they go live.

Also, keep an eye on your network connectivity to avert disruptions in communication with the API servers.

Monitoring error logs gives insight into recurring patterns that may help you trace the root of the problems. And if all else fails, API support teams stand ready to guide you through more intricate challenges. Employing these methods ensures that you can adeptly handle common issues and maintain the seamless operation that is critical in today's business transactions.

It's essential to comprehend the core components of API Payment responses, such as amount, currency, and payment type, which are crucial in B2C transactions. Understanding these fields and their implications allows for a more nuanced approach to troubleshooting. By staying informed on the latest shifts in testing methodologies, like ‘Shift Left’ testing, and engaging with developer communities through events and forums, you can continue to fine-tune your approach and keep your payment integration robust.

Conclusion

In summary, Payment APIs are essential for businesses to thrive in the digital marketplace. They serve as digital conductors, seamlessly managing transactions between merchants, customers, and financial institutions. By accepting a wide range of payment methods, businesses can enhance the user experience through convenience and choice, while prioritizing security measures to protect sensitive information.

Payment APIs, like Razorpay, exemplify versatility and seamless integration across different platforms. Developers can easily adapt the API to various programming languages, ensuring broad applicability without the need for specialized software development kits (SDKs).

Decoding API payment responses provides valuable insights for businesses to streamline their payment processes. Understanding the components of payment responses, such as amount, currency, payment type, and customer ID, allows for deeper insights and optimization of payment processes.

Clear API documentation and user education are increasingly important in the evolving digital payments landscape. The Global Payments Report 2023 highlights the growing popularity of alternative payment methods and real-time transactions. To stay ahead, businesses must prioritize clear documentation and user education for seamless integration and adoption of Payment APIs.

In conclusion, Payment APIs are pivotal in facilitating efficient and secure transactions in the digital economy. They empower businesses to conduct transactions with ease and effectiveness, enhancing the user experience and streamlining complex payment processes. By leveraging the benefits of Payment APIs, businesses can achieve maximum efficiency and productivity in their payment processing operations.

Frequently Asked Questions

What is a Payments API?

A Payments API is a digital tool that allows businesses to manage and facilitate financial transactions between merchants, customers, and financial institutions through various payment methods such as credit cards, digital wallets, and bank transfers.

Why is security important for Payments APIs?

Security is crucial for Payments APIs because they handle sensitive information like API keys and user credentials. It is vital to protect this data to maintain trust and prevent security breaches that could compromise the privacy and funds of customers and businesses.

How do Payments APIs benefit businesses?

Payments APIs offer businesses several benefits, including a diverse array of payment methods to cater to customer preferences, enhanced security protocols, scalable solutions for growth, features for recurring payments and fraud detection, and streamlined transaction management for better user experience.

What are the key components of a Payments API?

The key components include Authentication and Authorization, Payment Gateway, Payment Methods, Transaction Management, and Error Handling and Reporting. These components work together to secure and streamline the payment process.

How do you integrate a Payments API into an application?

To integrate a Payments API, select a provider, sign up for credentials, understand the API documentation, write and test the integration code, and then launch the system for live transactions. Utilize community forums and resources for support during this process.

What are some of the common Payment APIs available on the market?

Common Payment APIs include Stripe, PayPal, Braintree, and Square. These APIs differ in capabilities, supported payment methods, transaction fees, and developer support.

What security considerations should be taken into account for Payments APIs?

Important security measures include using HTTPS for data encryption, tokenization to protect card details, compliance with PCI DSS standards, two-factor authentication for user accounts, and regular security audits.

What are the best practices for implementing Payments APIs?

Best practices involve thoroughly understanding API documentation, implementing idempotent requests to prevent duplicate transactions, using webhooks for real-time updates, graceful error handling, continuous performance monitoring, and secure storage of API credentials.

How can issues with Payments APIs be troubleshooted?

Troubleshooting involves reviewing API documentation, verifying API credentials, using sandbox environments for testing, monitoring network connectivity, examining error logs, and contacting support teams for complex issues. Understanding API Payment response fields is also essential for diagnosing problems effectively.